Contact us

Get in touch with our experts to find out the possibilities daily truth data holds for your organization.

Persistent Monitoring

Natural catastrophe solutions

15 June 2023 | Solutions

4 min read

Strategic Account Manager, ICEYE

Insurers are now using it to transform claim triage, expedite claims payments - sometimes without necessitating “on the ground” inspections, and reducing the occurrence of late reported claims. Unlike drones, aircraft, and optical satellites, radar satellites can operate through clouds, rain, smoke, ash and in the dark, providing 24/7 capability that enables speed, scale and granularity of data insight that has no equal, and before most claims are reported.

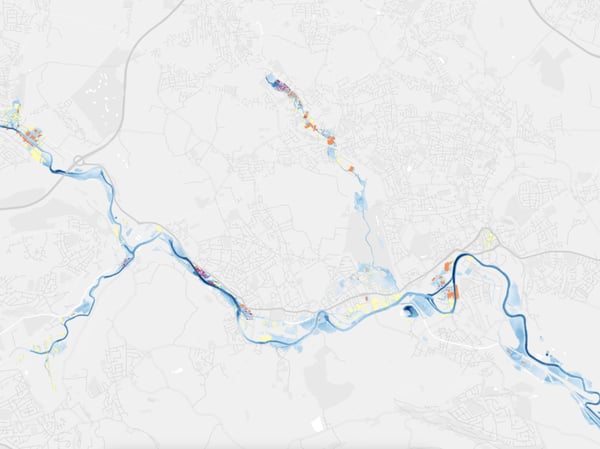

Our SAR satellite constellation provides insurers with a comprehensive “big picture” detailed view of a flood within 24 hours of the flood’s peak. This, in combination with the policy data, means insurers can pinpoint which customers are most likely to be impacted by the flood and how severely, as indicated by the depth of the flood water around the insured buildings.

ICEYE's flood extent and depth visualization after Storm Franklin in the UK

This insight accelerates, foreshortens and improves the accuracy of core flood event response processes and claim decision-making, including:

In the quest to provide the best response to their customers while also protecting their commercial interests, some insurers are standing up permanent Event Management platforms. These platforms, powered by radar satellite data, offer a single platform that an insurer uses throughout the lifecycle of a catastrophe event, from the weeks leading up to a specific event, to the aftermath when the flood waters have receded.

Before & after animation of flooding along the Pajaro River in California

The value of these platforms is immense, providing insurers with a topological map that overlays customer locations, event footprints, policy financials, indication of severity, and even reinsurance impacts at both location and portfolio levels. They also offer live media feeds, weather forecasts, and live geo-coded video footage from on-the-ground field resources such as loss adjusters, drying companies, and customer claim footage.

However, for these platforms to be truly effective, they must consider network stress and ensure extremely high levels of security encryption to protect data privacy and ensure data veracity.

24 April 2025

Forecasting complexity: What the 2025 hurricane season brings for disaster response

Explore what the 2025 hurricane season could bring and how real-time observation enhances hurricane...

Read more about Forecasting complexity: What the 2025 hurricane season brings for disaster response →05 March 2025

Beyond 99% Precision: How ICEYE’s observed data improved wildfire response in Los Angeles

Discover how ICEYE’s observed wildfire data helped insurers and emergency managers respond to the...

Read more about Beyond 99% Precision: How ICEYE’s observed data improved wildfire response in Los Angeles →19 February 2025

Insurers' guide to accessing and visualizing ICEYE Flood Insights

Learn how insurers can make insightful business decisions with ICEYE Flood Insights and all the...

Read more about Insurers' guide to accessing and visualizing ICEYE Flood Insights →